While most students cannot wait to be seniors and “top dogs” at RB, there is still a lot of pressure and hard work needed from seniors, particularly when it comes to planning for college. With January ending and just a few months to go until May 1, the national deadline for committing and paying the down payment on college for the Fall, tough decisions need to be made.

Many seniors are done with their college applications and have gotten acceptance letters back and it may seem like they are done with the entire college process. However, now that the application process is over, seniors need to decide which college they will be attending and, just as importantly, discuss the price tag with their parents. College tuition is so high that it can become the deciding factor in deciding which school to attend. How should seniors and their families get the best bang for their buck? Eveyrone in the family, parents and students included, needs to do their homework and look into ways to lower the cost.

School Scholarships

The scholarships offered by your college will probably be the largest amount of tuition support that you will receive. These scholarships come from the college in your acceptance letter based on your application, test scores, GPA, and school involvement.

FAFSA

Did you fill out your Free Application for Federal Student Aid (FAFSA) form? The deadline is Feburary 15, and the earlier you and your family fill out the form, the better chance you have to get money from the federal government before they run out. If you are your family are having trouble filling out the form, there is a FAFSA workshop in the RB library on January 31 from 7-8 p.m.. Your counselor in Student Services can help you as well.

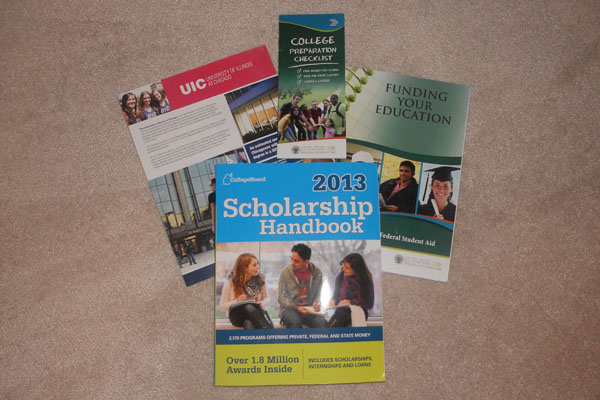

General/Local Scholarships

Check out the 2013 scholarship books from your local library or purchase them from Amazon or Banres and Noble. You can also look at web sites like Federal Student Aid or Fast Web to help search for differrent scholarships that may be a match for you. RB’s Student Services page can also be a good tool for finding scholarships.

It’s Not Too Late to Save

If you have not done so already, start saving. If you have a job, bank that money even though it’s more fun and easier just to spend it. College isn’t just tuition. It’s also books, food, board, and other costs.

Loans

Look into different loans your family and you can get to help pay for the cost of college. Compare different loans and interest rates. You will have to pay the loan back, but it can be helpful to get some financial assistance in the short term.

Job Opportunities

Look into getting an on-campus job at your college to help out with money. With on-campus jobs, the college works with your school schedule because they know that academics come first.

Talk

Do sit down and talk to your parents about the financial state of your household. Find out how much your parents are thinking about contributing and what price range to stay within when considering schools.

These are just some tips to help you sleep better at night knowing that there are many opportunities to help pay for your college tuition. Don’t get too scared by the colleges price tag at first because there are ways to afford your dream college. After you are accepted into your colleges then it is time to narrow down your schools by seeing which ones you can see yourself attending and then talk money. So start saving, talking, and looking for ways to save up for your college tuition.